This is a guest blog from two University of Manchester (UK) doctoral students involved in researching the causal mechanisms linking policy interventions to decoupling outcomes, with implications for innovation ecosystems and global governance.

Earlier this year, the release of DeepSeek—an open-source large language model from China—intensified the technological competition between the United States and China. In response, one U.S. lawmaker proposed the “Decoupling America’s Artificial Intelligence Capabilities from China Act” (S.321), which directly promotes “technological decoupling.” The University System of Georgia swiftly placed DeepSeek on their prohibited applications list—citing data security and cybersecurity risks—alongside platforms like TikTok and WeChat. This rapid escalation of restrictions highlights how AI tools can become flashpoints for broader geopolitical and commercial tensions.

Technological Decoupling: An Overview

Historically, whenever a rising power’s industries approached U.S. competitiveness—from the Soviet Union’s space and missile technology to Japan’s semiconductor edge in the 1980s—the U.S. responded with economic sanctions and technological blockades. Today, as China’s high-tech sectors advance, Washington perceives a similar threat, prompting an intensified containment strategy. In 2010, the U.S. National Security Strategy called for deeper cooperation with China. By 2017, however, China was designated a “strategic competitor,” and in 2022 the U.S. described China as the only competitor “with both the intent and power to reshape the international order.”

Although these doctrines did not explicitly single out AI, they marked a shift from cooperation to rivalry—laying the groundwork for Washington to more aggressively curb China’s advanced technology capabilities. As AI and semiconductors rose to prominence as engines of economic and military power, they became prime targets in the push to contain China’s technological rise.

Nonetheless, the profound interdependencies inherent in global supply chains significantly constrain the feasibility of a full-scale economic or trade decoupling. While the U.S. has tried shifting production away from China to nations like Vietnam and Mexico, fully removing China from global supply chains remains a major hurdle. Take Samsung, for example: although its smartphones and telecom equipment are assembled in Vietnam, critical components—such as electrical capacitors—still come from China, effectively keeping China embedded in the supply chain. Similarly, reshoring advanced manufacturing to the U.S. faces cost, labor, and policy barriers. Albemarle, the world’s largest lithium producer, recently paused its planned U.S. refinery project due to market uncertainties, highlighting the challenges of replacing China’s well-established industrial capacity.

As a result, Washington has focused on restricting access to critical components and R&D collaborations to curtail China’s advancements more directly and rapidly than broader trade or industrial relocations.

U.S.-China technological decoupling is a multifaceted process, extending beyond export controls and trade barriers to encompass the many ways the two countries collaborate and depend on each other to chart their technological futures. Although the term itself is broad, its real-world implications become clearer when we break it down into three key dimensions: collaboration, dependence, and divergence.

A. Declining Technological Collaboration

In recent years, the volume and scope of joint R&D projects between American and Chinese institutions have waned. Workshops, conferences, and professional exchanges once played a crucial role in advancing bilateral innovation, yet they are now fewer and more restricted. Cross-licensing agreements for patented technologies—an indicator of mutual trust in sharing intellectual property—have also dropped, highlighting a growing reluctance to pool resources across national boundaries.

B. Diminishing Technological Dependence

Alongside diminishing collaboration, both nations are striving to reduce reliance on each other’s core scientific and industrial capabilities. For instance, fewer Chinese publications cite U.S. research compared to a few years ago, and many Chinese firms have sought local or alternative suppliers for advanced components. This trend underscores a strategic effort to insulate domestic industries from external geopolitical risks and potential supply chain disruptions.

C. Divergence in Technological Trajectories

Finally, the two countries are embarking on divergent paths in fields like AI, semiconductors, and emerging technologies. Driven partly by national development goals and partly by restrictions on cross-border technology flows, each side invests in homegrown solutions that may ultimately result in parallel ecosystems. Over time, this divergence could lead to distinct technological standards and approaches—further complicating international collaboration and intensifying the strategic implications of decoupling.

Why AI Is the Prime Target

The decoupling argument considers the development of machine learning applications to be a “race,” and a race implies one winner and all others as losers. This framing may not be valid.

Those who believe in decoupling with China cite three main reasons. First, national security: AI powers drones, autonomous weapons, and advanced military command systems. While there will certainly be military applications of AI, their ability to guarantee superiority on the battlefield is not so simple. Georgia Tech researchers have noted that “The conditions that make AI work in commerce are the conditions that are hardest to meet in a military environment because of its unpredictability.”

Second, economic growth: according to one consultancy study, AI has the potential to nearly double the rate of economic growth over the next ten years. Some believe that the AI leader will dominate the world economically. Aside from the speculative nature of these growth projections, growth will hinge not on technological leadership per se, but on the ability of businesses and organizations to make productive use of the applications, as Jeffrey Ding’s study of technological diffusion shows. Furthermore, because the digital ecosystem that supports AI applications is highly globalized, one country’s leadership in AI does not mean the resulting growth will be confined to that country.

Third, there is a belief that the leader in the Ai race will establish global technological standards, just as the “Wintel” PC architecture and the internet protocols previously guided foundational computing ecosystems. Here again, the parallel may not be valid. LLMs and other machine learning applications work at the application layer and do not require the kind of universal compatibility that computer operating systems and networking require. There may be no AI equivalent of Wintel.

The Chip Supply Chain and AI Dominance

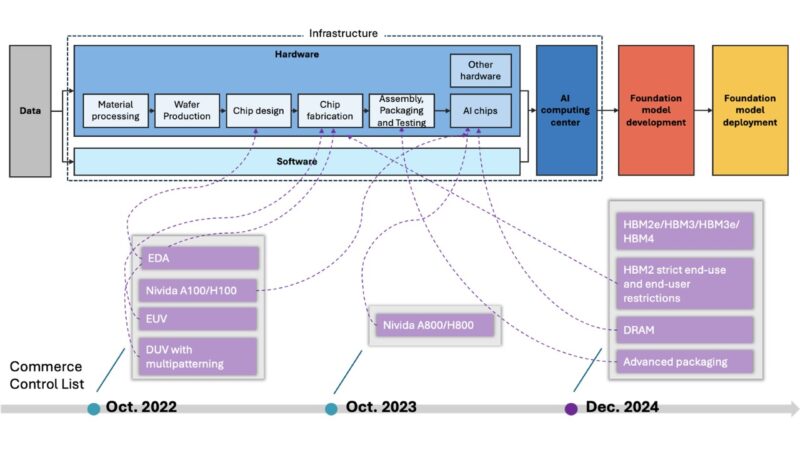

AI applications come from a robust digital ecosystem built on four foundational pillars: computing devices, networks, data, and software. Among these, computing devices—particularly advanced semiconductors—provide the essential processing power behind sophisticated AI models. The U.S. has imposed targeted, layered sanctions on China across multiple ecosystem components. It has focused most intensively on the semiconductor supply chain, which U.S. leaders see as a critical bottleneck that can be weaponized. By cutting off China’s access to high-end chips, advanced manufacturing equipment and design software, Washington aims to constrain China’s development of AI foundation models. This strategy reflects broader geopolitical goals: preserving the U.S.’s technological leadership in AI and preempting China from shaping the emerging global norms, standards, and governance structures surrounding AI technologies. The escalating export restrictions under the Commerce Control List (CCL) vividly illustrate why semiconductors have become the central battlefield in this AI-focused technological decoupling effort. Training foundation models—and, by extension, advanced AI applications—requires cutting-edge chip design and manufacturing capabilities, making semiconductors a natural focal point for targeted export controls from Washington.

Initially, U.S. restrictions focused on key technology bottlenecks, including specialized Electronic Design Automation (EDA) software provided by companies like Cadence and Synopsys, which are essential for chip design; Extreme Ultraviolet (EUV) lithography equipment from ASML crucial for advanced chip fabrication; and high-performance GPUs such as NVIDIA’s A100 and H100, essential for AI training workloads. Starting in October 2022, exports of these critical technologies to China were explicitly banned. As Chinese firms began adapting to these restrictions, the U.S. expanded its controls. By October 2023, export regulations encompassed modified GPU variants—including NVIDIA’s A800 and H800—initially designed with reduced capabilities to comply with earlier rules. This move eliminated previous compliance loopholes, underscoring Washington’s commitment to restricting even downgraded technological flows. These measures have tightened even further after 2024. Restrictions on high-bandwidth memory (HBM) and advanced chip packaging will significantly hinder China’s domestic capabilities to produce cutting-edge AI hardware.

Collectively, these escalating controls create significant operational uncertainties for technology firms operating within or connected to China’s semiconductor ecosystem. Companies face elevated risks related to supply chain disruptions, heightened complexity in long-term R&D strategies, and increased compliance requirements, making strategic planning increasingly challenging amid intensifying U.S.-China technological rivalry.

Decoupling or Trade?

Our research builds on Han et al.‘s method of measuring decoupling and dependence We find that the level of U.S.-China “AI decoupling” varies significantly across different subfields. In foundational techniques—such as advanced algorithms or machine learning—China maintains a pronounced reliance on U.S. technology. But in application domains like robotics, we are witnessing a reverse dependency from the U.S. on China’s manufacturing capabilities, supply chain efficiency, and large-scale adoption environments. These interdependencies reflect the underlying reality that the American and Chinese AI ecosystems remain deeply intertwined, with each side offering strengths that amplify the other’s progress. This mutual dependence underscores how collaboration—formal or informal—can substantially accelerate AI’s overall progress. Conversely, a more severe decoupling risks undermining both countries’ capacity to innovate, by mandating parallel R&D and duplicative infrastructure.

Ultimately, despite the push for AI decoupling, the global tech landscape is deeply interlinked. Complete separation is costly and complex, leaving room for partial cooperation on select standards or foundational research. Yet the strategic uncertainty means that businesses must carefully map and hedge against the shifting fault lines of U.S.-China technological competition.

The post Unpacking US-China “Decoupling” in AI appeared first on Internet Governance Project.